When hiring for a growth team, it’s good to anchor your search around core traits. These traits I’ve come to realise don’t change, rather are built upon as a foundation. Every successful growth product manager, growth designer, growth marketer, growth analyst, growth engineer has them.

If you’re starting the hiring process for growth roles, start here. You won’t go wrong:

Analytical and user-centric

Look for a quantitative bias, where the individual is certainly analytical. This doesn’t mean they must be experts at SQL or Python. More so, they must be very comfortable with data, be able to interpret answers and experiments correctly. And some of the following:

Can map out user funnels numerically, highlighting drop off rates between funnel stages

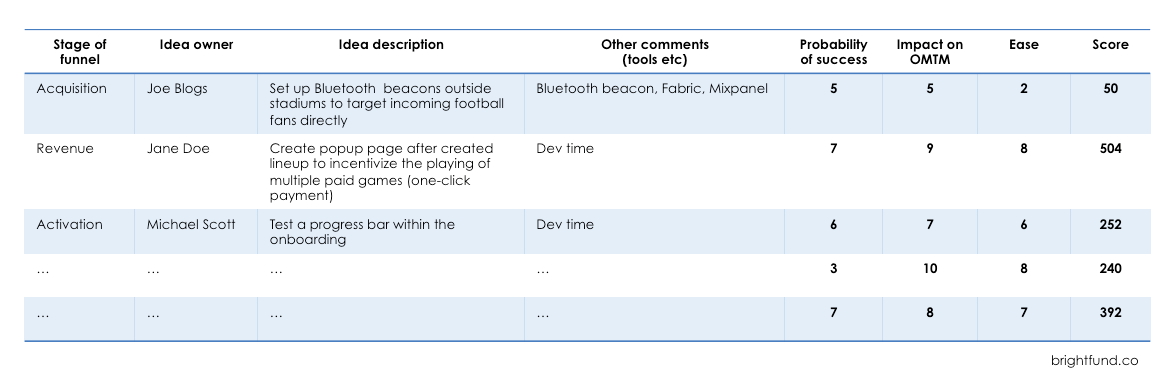

Size opportunities from problem spaces, weighing which levers and conversion points are most impactful for your KPIs

Effectively segment the user base to help uncover solutions, problems, or sample audiences for experiments

Form hypotheses around propensities to upgrade/churn based on own’s analysis

Make sure these individuals understand there’s a user behind every data point

Critical to know who these users are

What these users care about

What jobs need to be done from the users perspective to get value from your product

What jobs need to be done by your team to provide more value, quicker

Key is for these hires to balance both

Marketing DNA

Marketing DNA does’t mean these hires must be a content marketer or SEO specialist. Rather, they must have routed understanding of marketings value and impact. Some of the following:

The value of messaging and positioning, and how getting these wrong can be detrimental to all growth activities

Knowledge of the end-to-end user lifecycle and ideally user sentiment at each stage

The value of user research and how it provides clarity on problem areas

Willingness to AB test things, importantly knowing when and when not to test

Behavioural psychology that permeates all experiments

Results & execution oriented

No brainer. Once hires have shown they can research, learn and set experiments, here is where they put the “growth” in growth [enter almost any role ever].

Results

They’re super excited about moving numbers. Growth = scientific method applied to business KPIs

Showing a relentless drive to improve those metrics - they’re never complacent

Execution

Thrive in an operating cadence centred around growing numbers

Work effectively with other teams, able to get the best out of them

Hope that’s helpful.